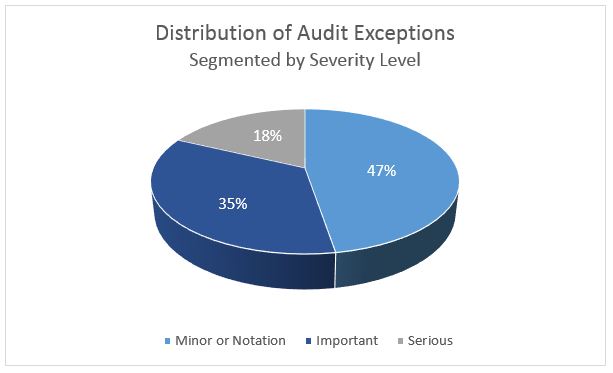

To identify frequently occurring mortgage Quality Control audit exceptions, TENA analyzed the findings from thousands of QC audits it completed during the first quarter of 2016. The distribution of audit exceptions, segmented by their severity level, is presented in the graph that follows.

The analysis of audit findings identified numerous post-closing audit exceptions that were frequently cited during the first quarter of 2016. Although the largest concentration of such frequently cited issues was attributable to the Loan Estimate and Closing Disclosure, those findings are not included in this summary; they were already presented in a previous TRID Results Analysis produced by TENA which can be accessed at Do Your TRID Disclosures Have the Right Stuff?

Other audit citations that TENA frequently noted during the first three months of 2016 include:

- Income documentation insufficient: (Severity = Serious)

The majority of these income documentation findings occurred because there was no evidence that the required verbal employment verification for self-employed borrowers was completed by the lender.

Many exceptions were noted regarding missing income documents, most frequently: a) paystubs covering one month of pay; and b) W-2s. In addition to being an audit exception, whenever these documents are not found in the file, the ability to perform required income/employment reverifications is also compromised.

- Data Integrity deficiencies regarding the Appraised Value on Automated Underwriting Reports: (Severity = Serious)

The agencies have indicated that the Appraised Value on the appraisal MUST MATCH the appraised value as shown on the Automated Underwriting Report and that if they do not match, the Automated Underwriting Report must be re-run. Failure to comply with this requirement is classified as a defect. This rule remains true even in circumstances when the appraised value shown on the appraisal is higher than that which is reflected on the automated underwriting report. Although such a circumstance would seemingly mean the loan had an even lower risk, the data discrepancy is nevertheless still treated as a defect. This requirement appears to be a detail that is frequently overlooked during underwriting.

- Borrower not employed at closing (Severity = Serious)

On April 22nd TENA updated its employment reverification letters and added an inquiry regarding whether the borrower was employed as of the date of closing. To date, just over 1% of the returned employment reverifications have indicated that the borrower was no longer employed when the loan closed. This constitutes a serious defect because the loans are no longer saleable to investors or eligible for FHA insurance. Furthermore, if the loan has already been sold, it likely will require that the lender self-report the issue. In an effort to stem the occurrence of this finding, TENA recommends that: a) the lender perform the verbal employment verification(s) on or as close to the day of closing as possible; b) the lender clarify to the borrower(s) that the employment status represented on the application must remain true throughout the entire origination and closing process; and, c) the lender notifies the borrower(s) that it is a fraudulent act to sign the final application at time of closing if there has been a change in the represented employment status. (The Acknowledgement and Agreement section of the final application states that the information provided in the application is true and correct as of the date set forth opposite the borrower’s signature and that any intentional or negligent misrepresentation of this information contained in the application may result in civil liability, including monetary damages, to any person who may suffer a loss due to reliance upon any misrepresentation the borrower has made on the application, and/or in criminal penalties including, but not limited to, fine or imprisonment or both under the provision of Title 18, United States Code, Sec. 101, at seq.)

- Discrepancies between the review appraisal and the original appraisal: (Severity = Ranges from a Notation to Serious)

TENA’s audit analysis revealed numerous issues that were frequently noted by review appraisers on their field review appraisal reports. Some of these issues are significantly more important than others; nevertheless, the most frequently encountered comments on review appraisals include:

– Sales comparable were not appropriate;

– Adjustments to sales comparable were inconsistent or inappropriate;

– Significant variation in represented and actual gross living area;

– Discrepancies regarding stated site size;

– Incomplete history of sales listings;

– Variation in the description of neighborhood boundaries;

– Zoning differences;

– Sale or transfer history incorrect or incomplete.

A robust appraisal review process coupled with a mechanism to provide feedback to a firm’s appraisers may be of assistance in mitigating many of these common findings.

- Verbal verifications of employment that are outside of the required timeframes: (Severity = Notation)

TENA classified the severity of this type of audit finding only as “Notation” rather than citing it as an audit exception. That is because the verbal employment verification can be performed after closing and in some cases, as late as “time of delivery” to the investor. Consequently, not performing the verification by the time the QC audit is conducted can’t be classified as an audit exception. That notwithstanding, not having completed the task by the time the file is subjected to QC audit suggests that the requirement might easily be missed. Failure to complete this required reverification can have a significant impact on the salability of the file if it is later discovered that a borrower was not employed when the loan closed.

There is no hard evidence indicating why the frequency of this audit finding has recently increased; however, the time period when it did increase coincides with the adoption of the TRID disclosure procedures. It is possible that the increase in the frequency of this audit finding is associated with closing delays related to the TRID disclosure procedures. To ensure that this required reverification is systematically completed in all cases, TENA recommends that clients review their internal closing procedures to determine if sufficient triggers are in place to initiate the verbal employment verifications in a consistent and timely manner. For example, a routine procedure that initiates (and documents in the loan file) the reverification effort at the time the final Closing Disclosure is provided. Or a trigger to initiate the process upon receipt of the executed closing documents from the closing agent.

- The Loan Originator’s name does not match the NMLS database: (Severity = Notation)

The Truth-in-Lending Act (§1026.36(g)) requires that the name of the loan originator shown on loan documents must be “as the name appears” in the NMLSR. However, it is not uncommon to find that in the NMLSR, a loan originator’s full name may be reflected as, for example, Jonathon A. Smith while the loan documents list the name as Jon Smith. To be in compliance with the regulation: a) the loan originator’s name must be displayed on loan documents as Jonathon A. Smith to match the NMLSR listing; or b) in the NMLSR listing for that individual, the name Jon Smith must be entered under the AKA section for Jonathon A. Smith.

- Missing Documentation: (Severity = Ranges from a Notation to Serious)

The most frequently noted missing documents are:

– Hazard insurance policies;

– Flood determinations;

– Purchase agreements;

– Written lists of service providers; and

– Initial and/or final applications.

Because findings of this nature can generally be cured relatively quickly, they are sometimes brushed aside as being a “nuisance” finding. Nevertheless, it takes time and resources to track down such missing documentation. Additionally, the cure effort is often extended only to the audited loan files that were indicated as having missing documents and not to the majority of loan files that were not included in the QC audit. Depending on the frequency with which documents are found to be missing during the audit, such exceptions may be indicative of a systemic procedural issue within a firm’s loan origination process.

Suggestion: For firms that repeatedly experience “missing document” QC audit exceptions, TENA suggests a robust remediation approach be considered that goes beyond simply curing the noted exceptions. Modifying internal procedures to mitigate or eliminate the problem globally will always be more cost effective. Simply burying a systemic problem by “curing” each noted audit occurrence means the documents missing in the remaining unaudited files must be dealt with at various times during the life of the loan (such as at time of sale and delivery, loss mitigation, foreclosure, etc.).