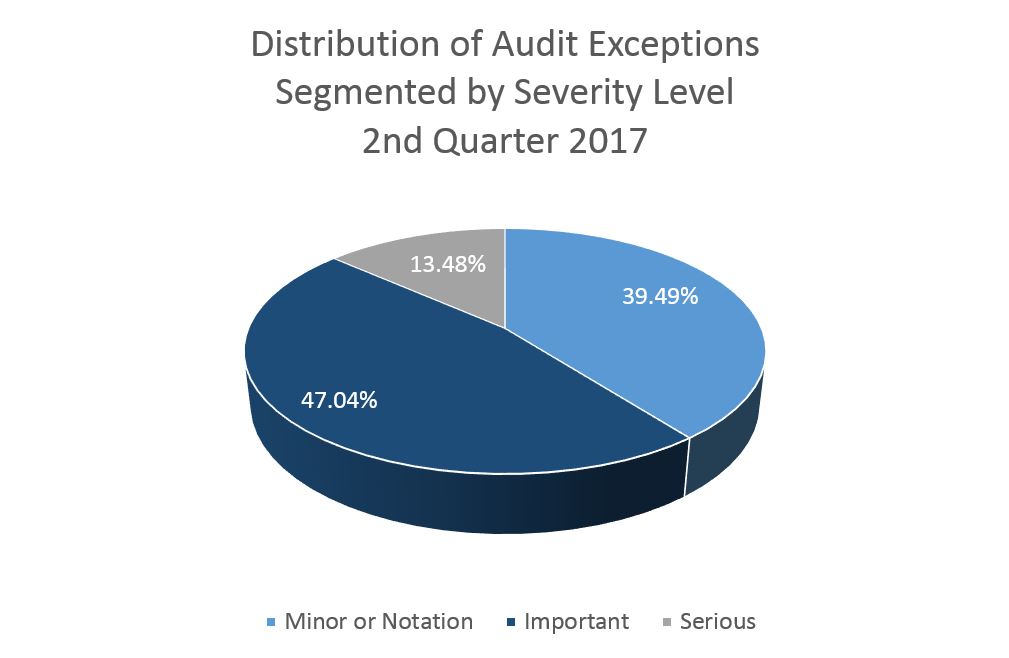

To identify mortgage origination Quality Control audit exceptions that occur frequently, TENA analyzed the audit results from thousands of Origination QC audits that it completed during the second quarter of 2017. The distribution of audit exceptions, segmented by their severity level, is presented in the graph that follows.

TENA’s analysis of audit findings identified numerous pre-funding and post-closing audit exceptions that were frequently cited during the second quarter of 2017. Those audit citations include:

- The file was missing a documented changed circumstance or evidence of an appropriate cure for changes in fees that exceed tolerances on the closing disclosure. (Severity = Serious)TENA’s analytics have revealed an increase in the number of findings related to fees increasing from the final Loan Estimate or a previous Closing Disclosure without a documented changed circumstance. Most of the findings related to this issue are due to the mandated fee rounding protocol that is applied to the Loan Estimate (http://www.consumerfinance.gov/eregulations/1026-37/2015-18239#1026-37-o-4) and the exact fee requirement on the Closing Disclosure (https://www.consumerfinance.gov/eregulations/1026-38/2013-28210#1026-38-t-4). When comparing the two numbers for zero tolerance fees, TENA’s auditors have found many fees triggering tolerance violations appear to be a result of rounding down to the nearest whole dollar on the Loan Estimate. For example, a credit report fee anticipated to be $24.45 must be rounded down and shown as $24 on the Loan Estimate. However on the Closing Disclosure, if the actual charge was $24.45, it must be listed as $24.45.Technically, this fee is in violation of the CFPB’s third requirement of zero tolerance for any increase. To overcome this problem, the CFPB has provided an official interpretation which allows for the use of unrounded numbers when conducting the good faith analysis regarding fee tolerances.“Use of Unrounded Numbers. Sections 1026.37(o)(4) and 1026.38(t)(4) require that the dollar amounts of certain charges disclosed on the Loan Estimate and Closing Disclosure, respectively, to be rounded to the nearest whole dollar. However, to conduct the good faith analysis required under §1026.19(e)(3)(i) and (ii), the creditor should use unrounded numbers to compare the actual charge paid by or imposed on the consumer for a settlement service with the estimated cost of the service.” http://www.consumerfinance.gov/eregulations/1026-Subpart-C-Interp/2013-28210#1026-19-e-3-i-Interp-6

For this provision to be relied upon during the processing, underwriting and subsequent audit of a loan transaction, separate documentation must be maintained in the loan file that establishes the pre-rounded value of the fees listed on the Loan Estimate.

- Missing evidence of the borrower’s consent for receiving loan documents electronically or missing evidence that the borrower(s) were provided with the required E-Sign disclosures prior to giving consent to receive loan documents electronically. (Severity = Important)Under the E-Sign Act providing consumers with information relating to a transaction in writing may be satisfied by using an electronic record if (A) the consumer has affirmatively consented to such use and not withdrawn such consent; and (B) prior to consenting the consumer has been provided with the appropriate disclosure. The E-Sign disclosure must contain clear and conspicuous statements (i) informing the consumer of any right or option to have the record provided or made available on paper or in non-electronic form, the right of the consumer to withdraw the consent to receive the record electronically, and any conditions, consequences or fees in the event of such withdrawal; (ii) what records the consumer’s consent applies to; (iii) how the consumer can withdraw their consent or update information needed to contact the consumer electronically; and (iv) informing the consumer how after the consent they can request a paper copy of the record and whether a fee will be charged for such copy.For many lenders the consent and disclosure are provided in the file; however, some lenders have indicated that the only way documents can be provided electronically is for the borrower to acknowledge that they received and read the disclosure and have opted to receive the information electronically through the lender’s system. Since the process is hard-coded into their system, these lenders are unable to provide the evidence necessary for TENA’s audit. Please contact your Solutions Desk representative to discuss additional options in this scenario.

- Verbal verifications of employment missing or outside of the required timeframes. (Severity = Ranges from Notification to Serious)Verbal verifications of employment can be performed after closing and in some cases, as late as “time of delivery” to the investor. However, not having completed the task by the time the file is subjected to audit suggests that the requirement might easily be missed. Failure to complete this required reverification can have a significant impact on the salability of the file if it is later discovered that a borrower was not employed when the loan closed.To ensure that this required reverification is systematically completed in all cases, TENA recommends that clients review their internal closing procedures to determine if sufficient triggers are in place to initiate the verbal employment verifications in a consistent and timely manner. For example, a routine procedure that initiates (and documents in the loan file) the reverification effort at the time the final Closing Disclosure is provided. Or a trigger to initiate the process upon receipt of the executed closing documents from the closing agent.

- Incomplete fields on the final application and missing or incomplete initial HUD/VA Addendum (Form HUD-92900-A or VA 26-1802a). (Severity = Ranges from Minor to Important)The most common finding related to incomplete fields on the final application is related to missing the legal address. The agencies indicate that all applicable fields on the final application should be completed. TENA has taken the stance that this is a field that is applicable to the loan transaction and should be completed. It is rated as a minor finding because it doesn’t impact the overall quality of the loan transaction, rather it is an indication that not all of the lender’s I’s are dotted and T’s are crossed.TENA also frequently identifies that the initial HUD/VA addendum is missing or incomplete on loans where the preliminary application indicates FHA as the loan type. FHA requires that the Mortgagee must obtain the borrower’s initial complete, signed application (Fannie Mae Form 1003/Freddie Mac Form 65) and page two of form HUD-92900-A before underwriting the mortgage application. The most common part that is found to be incomplete on form HUD-92900-A is the borrower’s occupancy certification in section 19.

- Missing closing instructions. (Severity = Notation)TENA analytics have shown that one of the most common missing documents that is frequently cited are the closing instructions. We cite this finding as a notification that we were unable to perform a review for compliance with the lenders instructions to the closing company without this documentation. The closing instructions provide additional clarity about loans that need to be paid at closing, fees and their placement on the closing disclosure and other miscellaneous details that were required to be completed at closing.

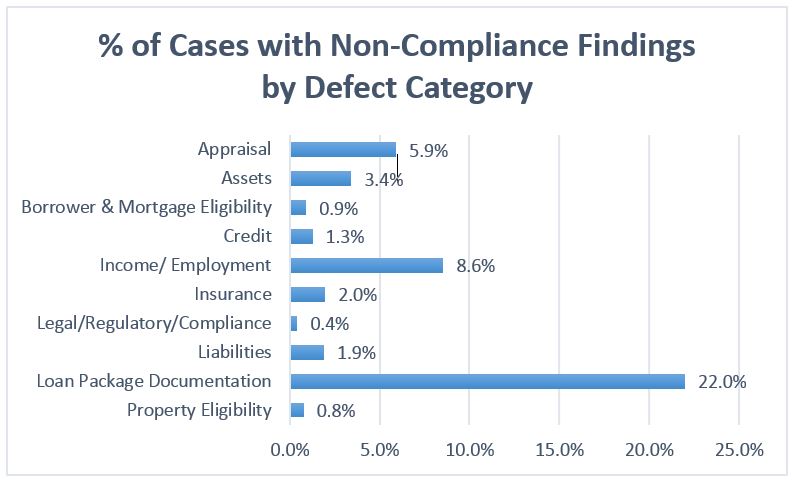

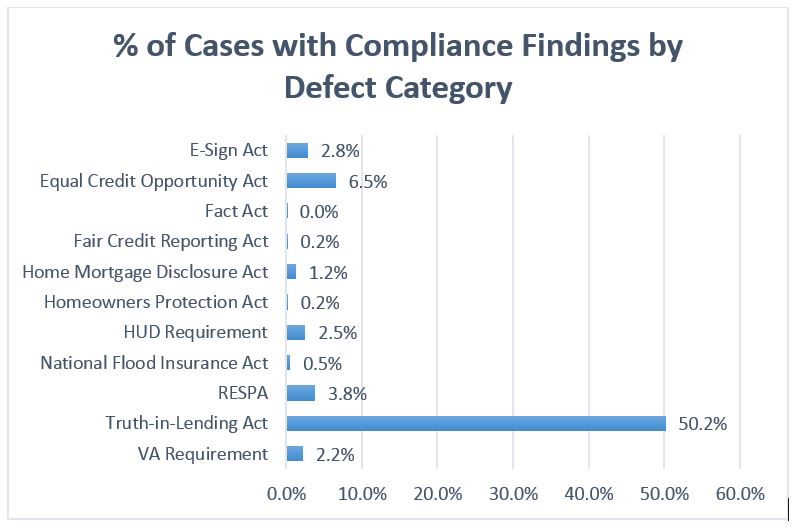

The graphs below reflect the percent of cases that were audited in the 2nd Quarter of 2017 with at least one exception in the defect categories reflected.