Over 25,000 mortgage servicing QC audit findings consisting of 1,500 separate and unique audit exceptions were cited during the fourth quarter of 2016. That data pool was analyzed to identify emerging trends and common findings. The following five audit findings were identified as being notable.

- Audit Finding: The applicable FHA Case Number was not included on one of more pages of the form HUD 27011, and/or the cover page of any claims correspondence and documents pertaining to that application did not contain said FHA Case Number.

The Claims and Disposition section of FHA 4000.1, Single Family Housing Policy Handbook became effective on September 30, 2016. The handbook specifies:

“The Mortgagee must ensure that the FHA case number is on all pages of form HUD-27011, Single Family Application for Insurance Benefits, and on the cover page of any claims correspondence and documents sent to the Mortgage Compliance Manager (MCM) and HUD.

TENA’s audit analysis revealed that a statistically significant number of findings were attributable to the loan servicer’s failure to fulfill this requirement.

TENA Recommendation: Relative to the Single Family Application for Insurance Benefits (form HUD-27001), review internal procedures to ensure that all participants are aware of this requirement regarding inclusion of the identifying FHA Case Number. Review all document templates involved in generating the HUD 27001 form or generating the cover letter for any claims correspondence and documents sent to the Mortgage Compliance Manager and HUD. Where applicable, modify those templates and/or internal processes to facilitate compliance with this procedural requirement.

To review the FHA SFHPH 4000.1 – IV.A.1.a.(iii) guide click here.

- Audit Finding: The payment reminder notice did not contain one or more of the five items of information required by Fannie Mae.

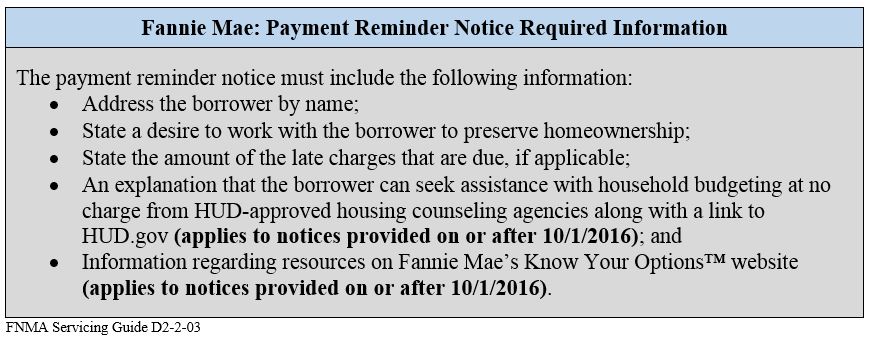

The Fannie Mae Single Family Servicing Guide indicates that if the mortgage payment has not been received, then the servicer must send a payment reminder notice to the borrower not later than the 17th day of delinquency. Effective October 1, 2016, on Fannie Mae loans, all payment reminder notices provided to the borrower must include five specific items of information. TENA analytics identified an increasing trend in the number of instances where servicers of Fannie Mae loans have not modified their payment reminder notices to fulfill this servicing requirement. Of the five items required by Fannie Mae, the two that TENA has most frequently noted as missing are: 1) A notification that the borrower may seek household budgeting assistance, at no charge, from HUD approved counselors; and, 2) Information making the borrower aware of additional resources that may be found on Fannie Mae’s Know Your Options™ website.

TENA Recommendation: Review the template for your firm’s Fannie Mae payment reminder notice to ensure that all five requirements listed in the table below are being effectively addressed:

To review the FNMA Servicing Guide D2-2-03 guide click here.

- Audit Finding: There is no evidence that a recorded mortgage satisfaction on a property located in Florida was sent to the borrower within 60 days of the loan being paid in full.

TENA’s fourth quarter audit findings revealed an increasing frequency of audit exceptions regarding the handling of loan satisfactions for properties located in Florida. Florida statute Title XL: Real and Personal Property, Chapter 701, Section 4, “Cancellation of Mortgages, Liens, and Judgements” reads as follows:

“Within 60 days after the date of receipt of the full payment of the mortgage, lien, or judgment, the person required to acknowledge satisfaction of the mortgage, lien, or judgment shall send or cause to be sent the recorded satisfaction to the person who has made the full payment.”

TENA Recommendation: Ascertain that your firm has procedures in place to ensure that: 1) for any paid-in-full loan secured by a property in Florida, a recorded satisfaction is sent to the applicable person within 60 days of receipt of the full payment; and 2) that evidence regarding the sending of said recorded satisfaction to the payee within the stipulated time period is appropriately documented in the loan servicing file.

To review this Florida requirement in detail, click the following link here.

- Audit Finding: A required periodic statement was not provided to the borrower.

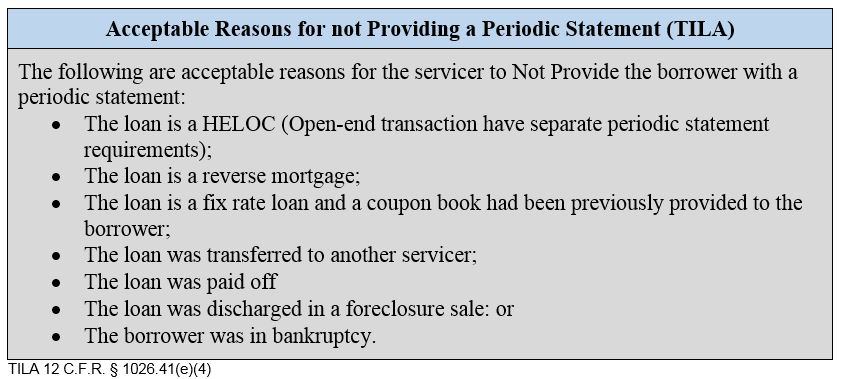

The Truth in Lending Act specifies that the servicer of any mortgage loan that is subject to section § 1026.41 shall provide the borrower a periodic statement each billing cycle. Additionally, the periodic statement is subject to timeliness requirements, delivery requirements, as well as content and layout specifications. The audit analysis revealed a significant increase in the number incidents when the servicer could provide no evidence that this requirement was being met either because: a) the evidence was missing; or b) the action was not performed at all. None of the acceptable reasons for not providing a periodic statement was applicable to these audit findings (see table below).

TENA Recommendation: Periodically review internal policies and procedures to ensure that; a) this requirement is being complied with; and b) if an acceptable reason for not providing the statement existed, that such reason is well documented and the applicable exclusion code has been accurately assigned.

To review the TILA 12 C.F.R. § 1026.41(e)(4) guide click here.

- Audit Finding: The written Notice of Loss Mitigation Denial document did not include all information required by the Real Estate Settlement Procedures Act (RESPA).

RESPA specifies that upon denial of a loss mitigation application, the loan servicer must provide specific information to the borrower in writing. An analysis of TENA’s fourth quarter audit findings revealed an increasing trend wherein such notices were missing one or more elements of required information. The most frequently noted findings involved the servicer’s failure to include information regarding: 1) the borrower’s right to appeal the denial of any loan modification option; 2) the requirements regarding how the borrower may make such an appeal; and/or 3) the amount of time the borrower has to file such an appeal.

TENA Recommendation: Review the content of your firm’s Notice of Loss Mitigation Denial to ensure that such notice includes all of the information required by RESPA.

To review RESPA 12 C.F.R. § 1024.41(c)(1)(ii) click here.